CommodityTrends Weekly Newsletter

Check our CommodityTrends Weekly Newsletter

Our Weekly Newsletter is published on a weekly basis. It is available online as well as emailed each week, exclusively for members of CommodityTrends.

View the trade opportunities and commodity markets Jim is watching to see where the markets may be headed.

Summary

Big Market Movers in 2025: A Year-End Look

As we close out 2025, the futures markets showed some clear areas of strength—along with a few markets that struggled. Looking at year-to-date performance helps highlight where money flowed this year and which sectors truly stood out.

The Big Winners in 2025

The metals sector was the clear leader in 2025.

Silver (Mar Silver) and Micro Silver (Mar Silver Micro) were the top performers, both up about 134% for the year. Silver was the standout market of 2025.

Platinum (Apr Platinum) wasn’t far behind, rising 118%, and Palladium (Mar Palladium) gained nearly 75%.

Gold (Apr Gold), both the standard and micro contracts, finished the year up 56%, showing strong and steady demand for precious metals.

High Grade Copper (Mar High Grade Copper), was up a very respectful 36%.

Other strong markets included:

Coffee (Mar Coffee), higher by 26%

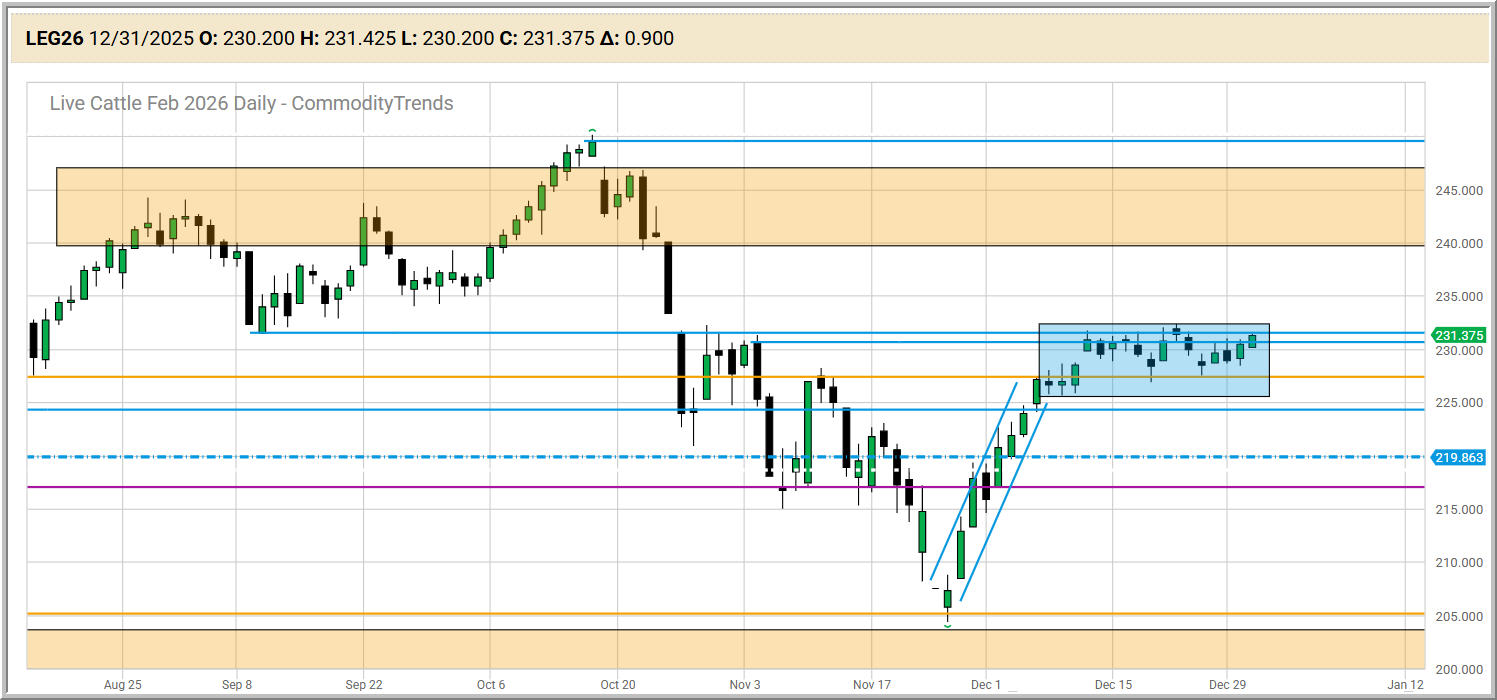

Feeder Cattle (Mar Feeder Cattle) and Live Cattle (Feb Live Cattle), both up over 20%

The Mexican Peso (Mar 2026), which gained about 23%

Overall, markets tied to real products—like metals, livestock, and agriculture—had a very strong year.

Markets That Struggled

Not every market had a good year. Some finished well below where they started:

Orange Juice (Mar Orange Juice) fell about 53%, making it one of the weakest markets of 2025.

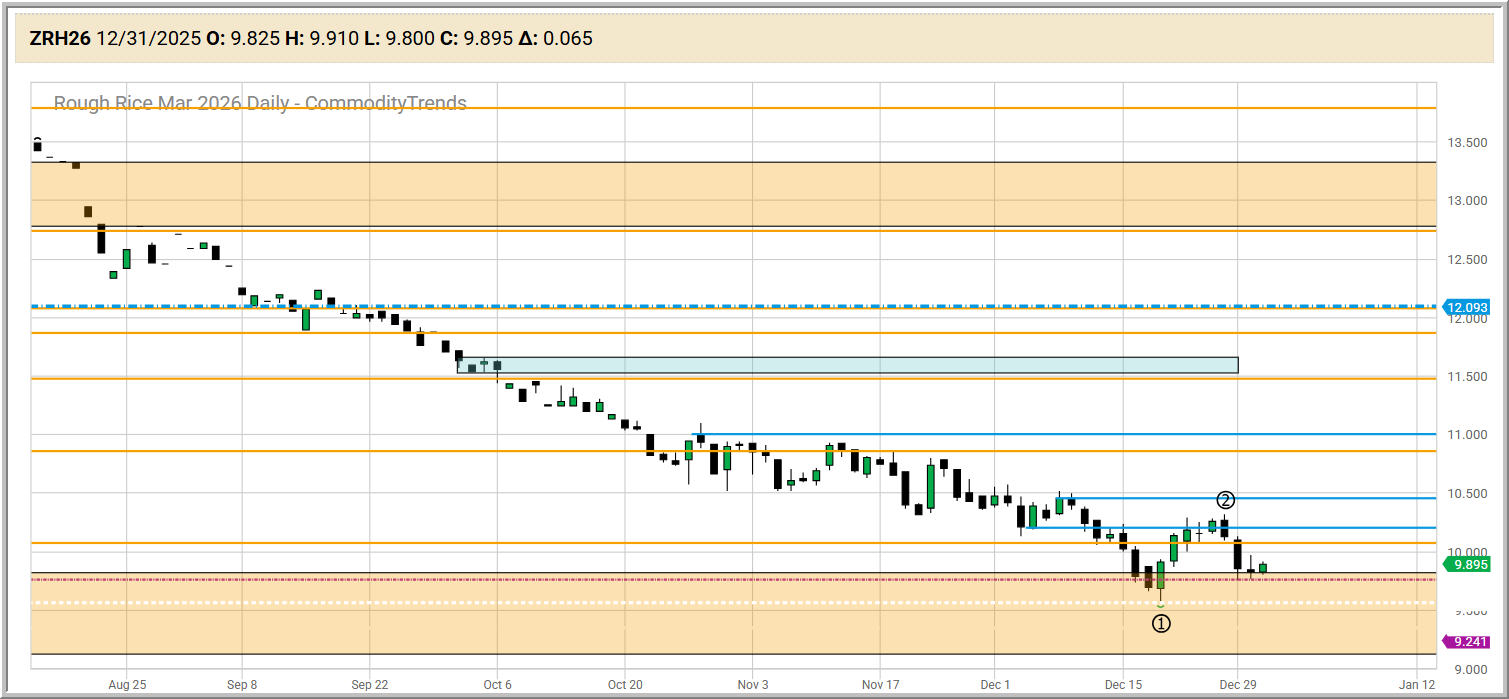

Rough Rice (Mar Rough Rice) dropped 31%, and Cocoa (Mar Cocoa) fell close to 29%.

Bitcoin Futures (Jan Bitcoin Futures) and Micro Bitcoin (Jan Bitcoin Micro) were both down about 26–27%, while Ether Futures (Jan Ether Futures) slipped around 21%.

The VIX (Jan S&P 500 VIX) rose about 30%, showing that traders faced plenty of market uncertainty this year.

The Big Takeaway

2025 was a year where metals clearly led the way, livestock held up well, and soft commodities were mixed. Crypto markets struggled, while volatility remained elevated at times.

As we head into 2026, this year-end snapshot helps show where strength has been—and where markets may still need time to recover.

Markets I'm Watching

View the trade opportunities and markets Jim is watching along with the Trend Seeker rating per commodity to see where the market is headed. Here are the markets and opportunities I am watching right now. For more information about these markets, be sure to check My Chart Book and CommodityTrends Daily Video Service.

Grains Market

For Mar Rough Rice, the #1 bottom point is 9.560 (the low on Dec. 18). The #2 point is 10.320 (the high on Dec. 26). Keep watching for all of the 1-2-3 strategy criteria to be met.

For Mar Rough Rice, the #1 bottom point is 9.560 (the low on Dec. 18). The #2 point is 10.320 (the high on Dec. 26). Keep watching for all of the 1-2-3 strategy criteria to be met.

Grains Market

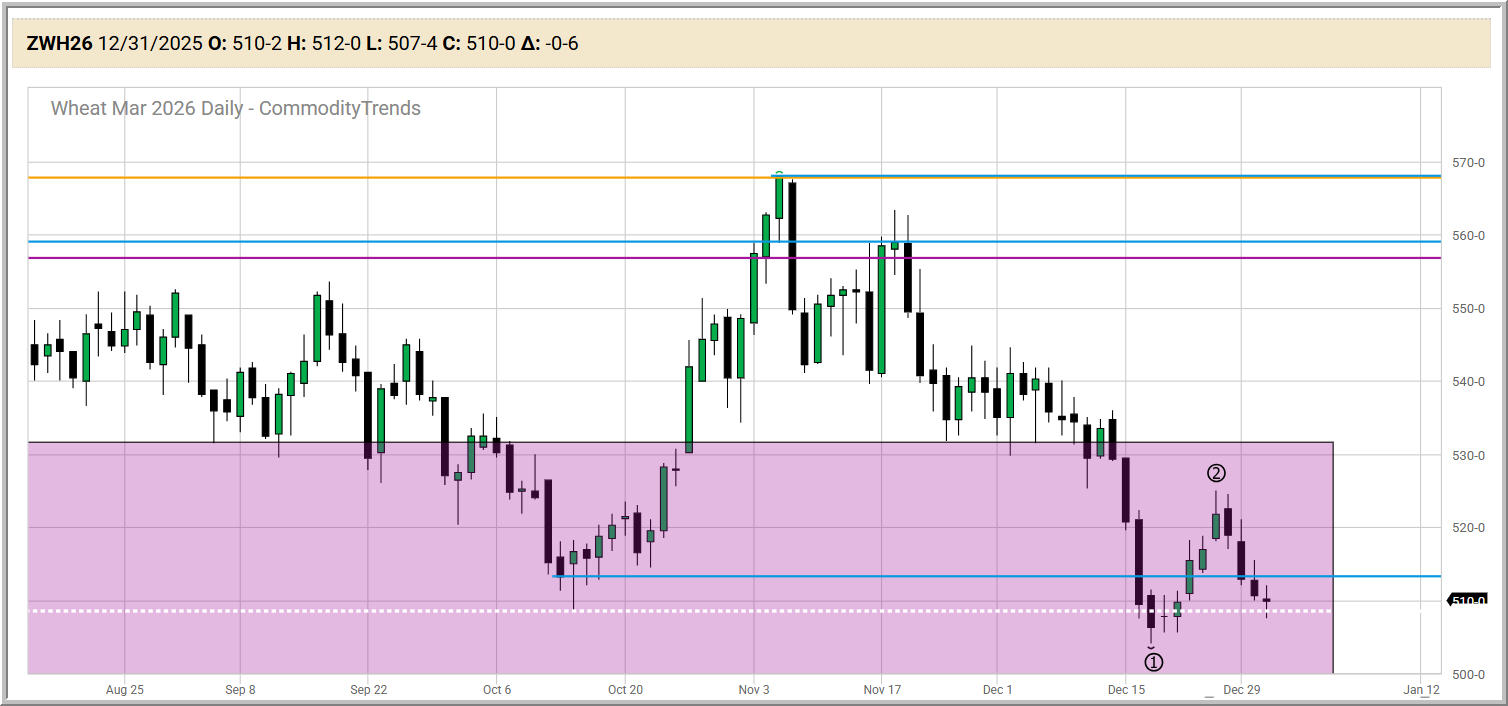

The #1 bottom point for Mar Wheat is 504-0 (the low on Dec. 17). The #2 point is 525-0 (the high on Dec. 24). Keep watching for all of the 1-2-3 strategy criteria to be met.

The #1 bottom point for Mar Wheat is 504-0 (the low on Dec. 17). The #2 point is 525-0 (the high on Dec. 24). Keep watching for all of the 1-2-3 strategy criteria to be met.

Meats Market

Feb Live Cattle has been moving sideways, forming a well-defined trading channel. Since the prior move was to the upside, a breakout above the top of the channel would signal a potential long entry. If the trade is triggered, an initial stop can be placed just below the recent channel lows. The first upside target is the lower edge of the weekly resistance zone (gold rectangle). Keep watching.

Feb Live Cattle has been moving sideways, forming a well-defined trading channel. Since the prior move was to the upside, a breakout above the top of the channel would signal a potential long entry. If the trade is triggered, an initial stop can be placed just below the recent channel lows. The first upside target is the lower edge of the weekly resistance zone (gold rectangle). Keep watching.

Foods/Softs Market

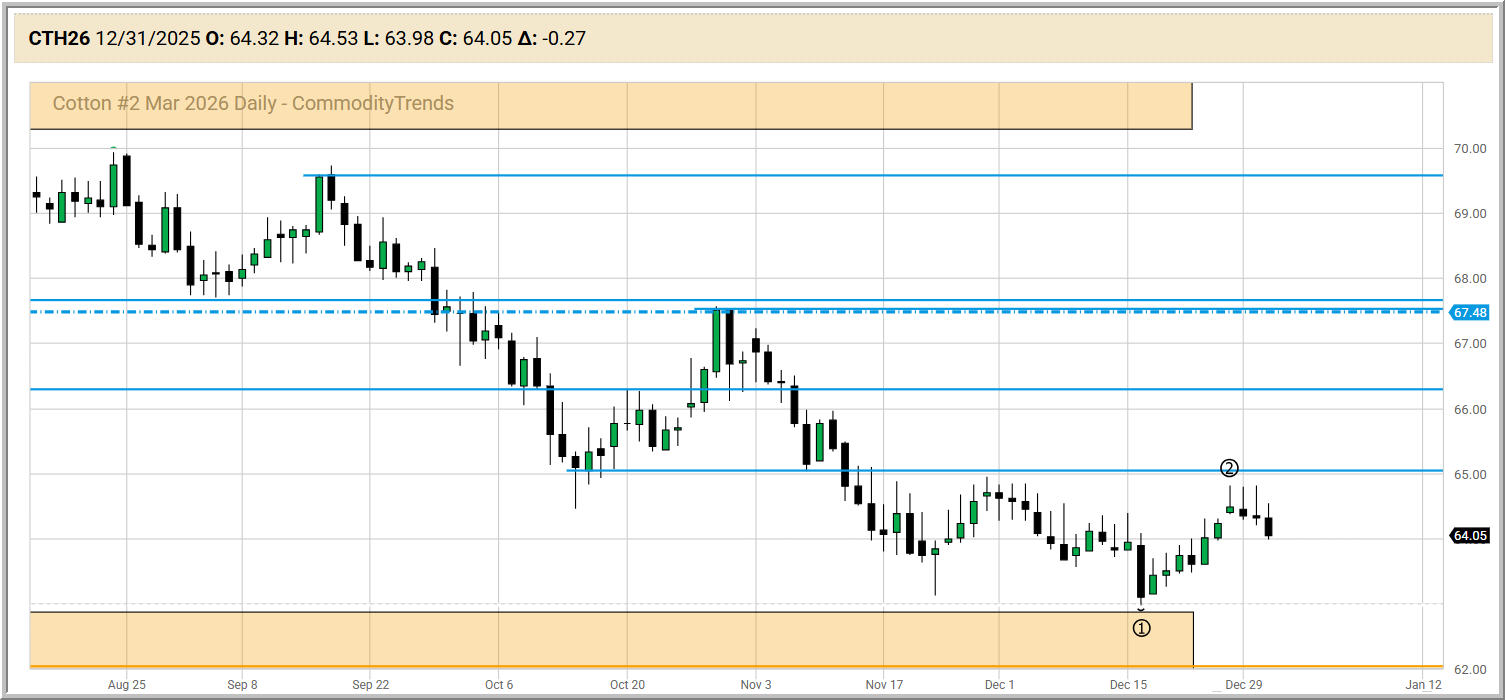

The #1 bottom point for Mar Cotton #2 is 62.97 (the low on Dec. 16). The #2 point is 64.81 (the high on Dec. 26). Keep watching for all of the 1-2-3 strategy criteria to be met.

The #1 bottom point for Mar Cotton #2 is 62.97 (the low on Dec. 16). The #2 point is 64.81 (the high on Dec. 26). Keep watching for all of the 1-2-3 strategy criteria to be met.

Foods/Softs Market

Mar Sugar #11 produced a #1 bottom point at 14.04 (the low on Nov. 06). The #2 point is 15.29 (the high on Nov. 28). The #3 point is at 14.38 (the low on Dec. 18).

Two weeks ago I wrote: "A long entry can be established on a break above the Dec. 19 high." The long entry was triggered on Dec. 22. The initial stop loss could be placed just below the #3 point. The initial target is the daily chart resistance level (blue horizontal line) at 16.33.

Mar Sugar #11 produced a #1 bottom point at 14.04 (the low on Nov. 06). The #2 point is 15.29 (the high on Nov. 28). The #3 point is at 14.38 (the low on Dec. 18).

Two weeks ago I wrote: "A long entry can be established on a break above the Dec. 19 high." The long entry was triggered on Dec. 22. The initial stop loss could be placed just below the #3 point. The initial target is the daily chart resistance level (blue horizontal line) at 16.33.